Matchless Tips About How To Apply For Vat Number

Sole proprietors in possession of a valid maltese identity card should click here to apply for a new vat number.

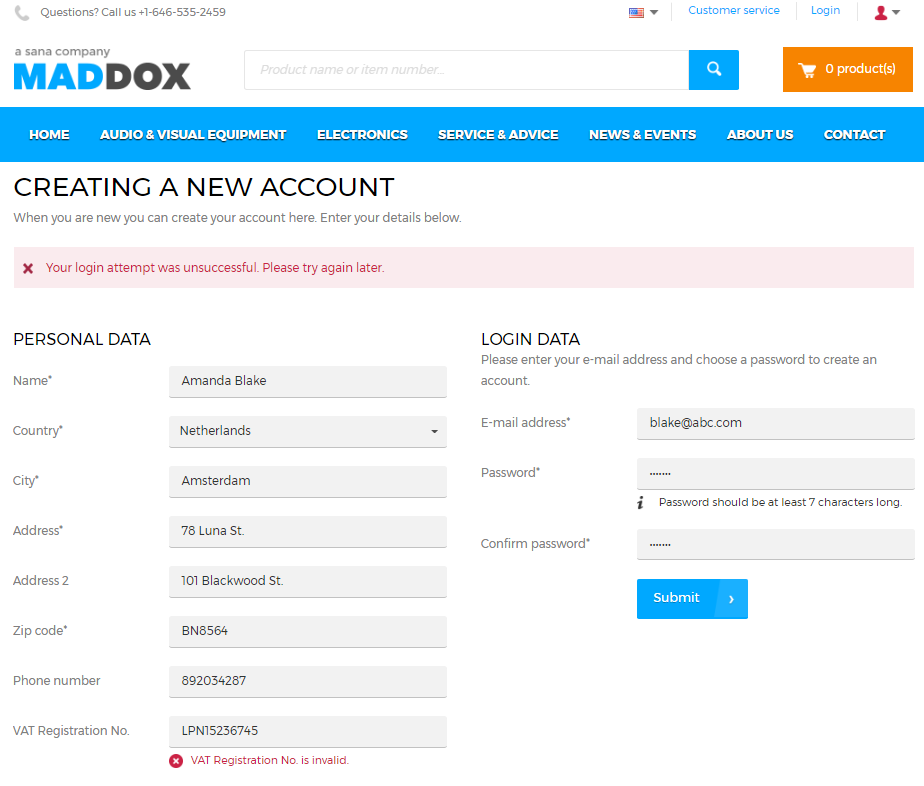

How to apply for vat number. In many cases, you can register for vat online. You can usually register for vat online. New applicants may register for a vat number by completing the proper application from the following list.

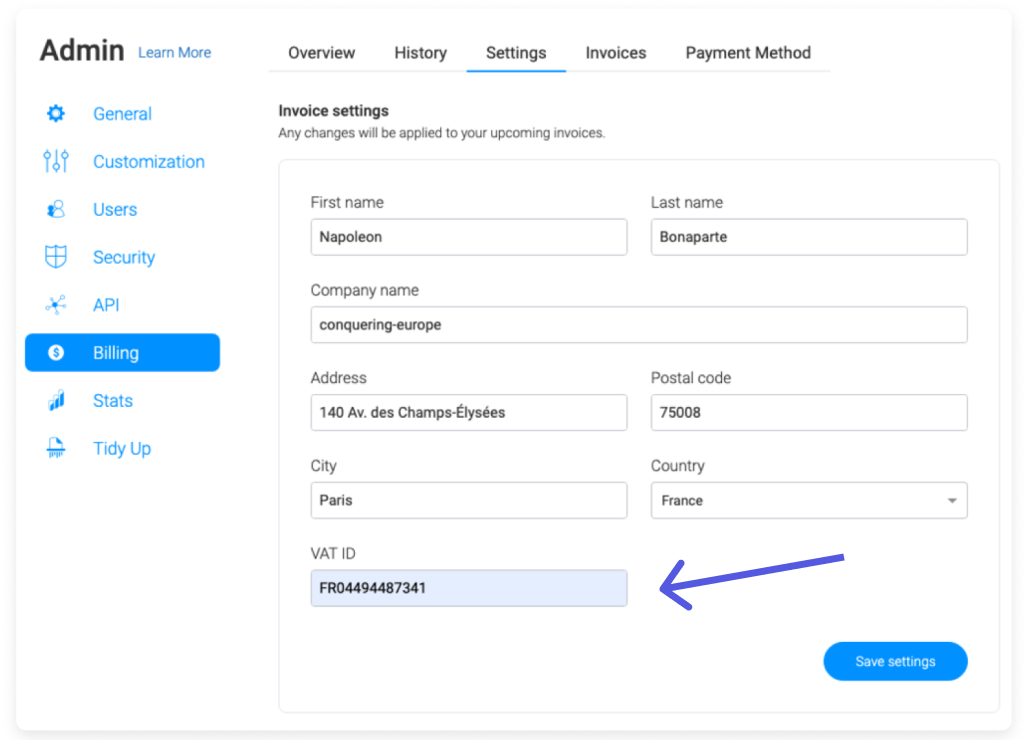

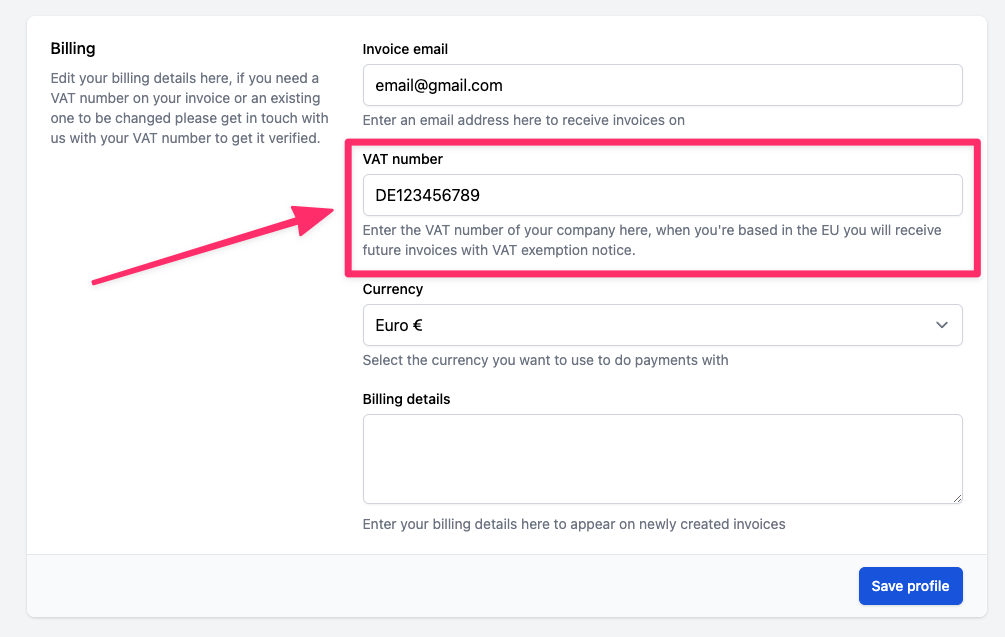

The recipient’s vat number must also be stated in the invoice. Once the obligation to vat register has been established, the process can begin. The code must appear in all invoices sent to foreign companies.

How to apply for a dutch vat number. The good news is that you may not have to visit the office in person. You can mention your rsin number (which will ultimately be activated as your vat number, you can find this number on your company extract in case you registered a company or branch in.

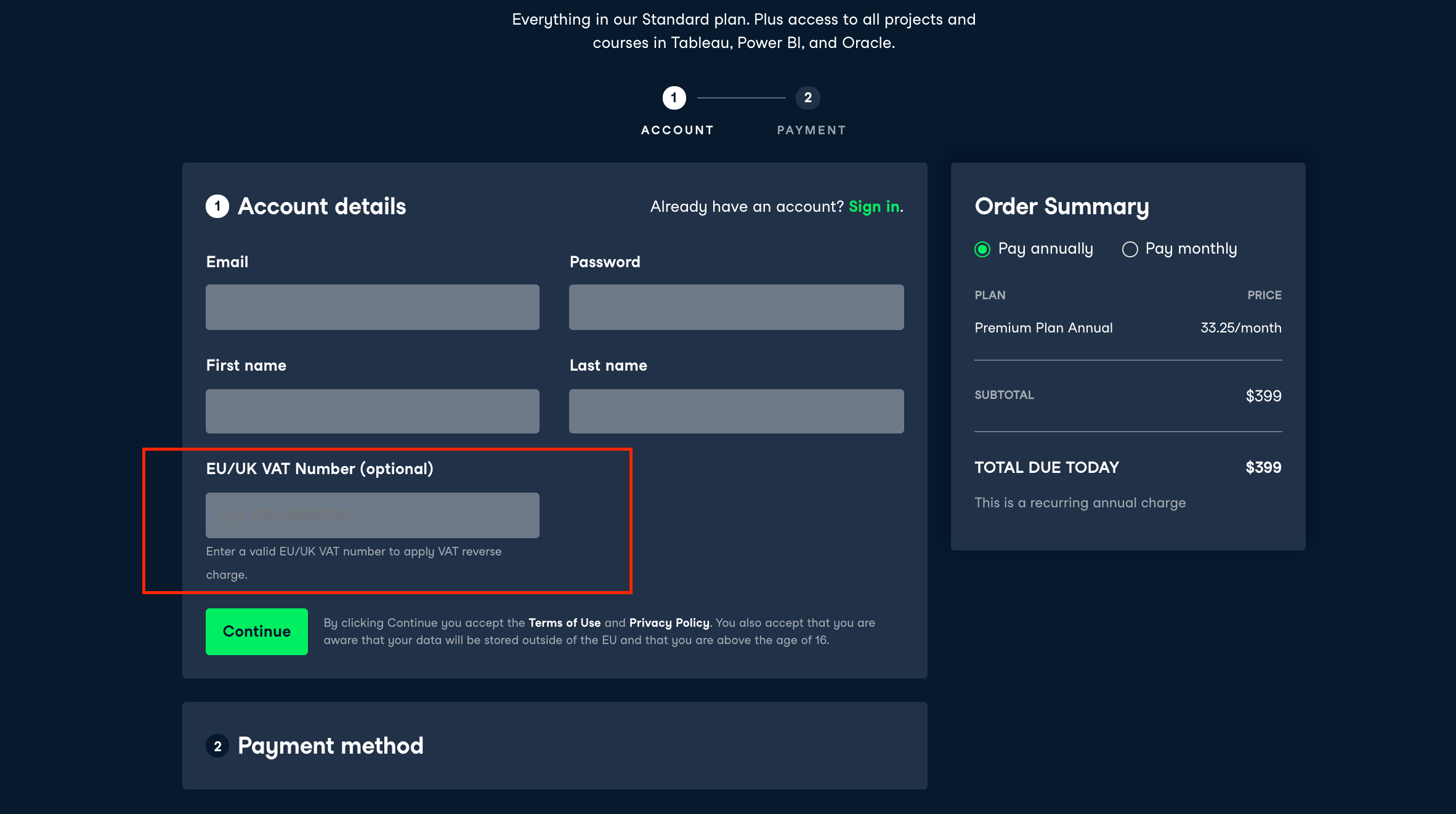

How to apply for the vat number? Follow the easy steps below to register for vat on efiling: 1) apply for a tax identification number (tin) in your country of residence by submitting documentation and waiting for.

To apply for an economic operators registration and identification number ( eori number) you need your: Sole proprietors in possession of a valid maltese. How do you register for vat?

The written application for the vat identification number must be sent to: By doing this you’ll register for vat and create a vat online account (sometimes known as a ‘government gateway account’). Your total vat taxable turnover for the last 12 months was over £85,000 (the vat threshold) you expect your turnover to go over £85,000 in the next 30 days.

Step 1 logon to your efiling profile step 2 navigate to sars registered details functionality: To help you better understand the vat registration process, we’ve outlined the steps needed to get a vat number, using ireland as an example: The first thing you need to do is to register your company with the trade register via the chamber of commerce.

There are two ways to obtain a vat number: