Beautiful Info About How To Avoid Exchange Rate Risk

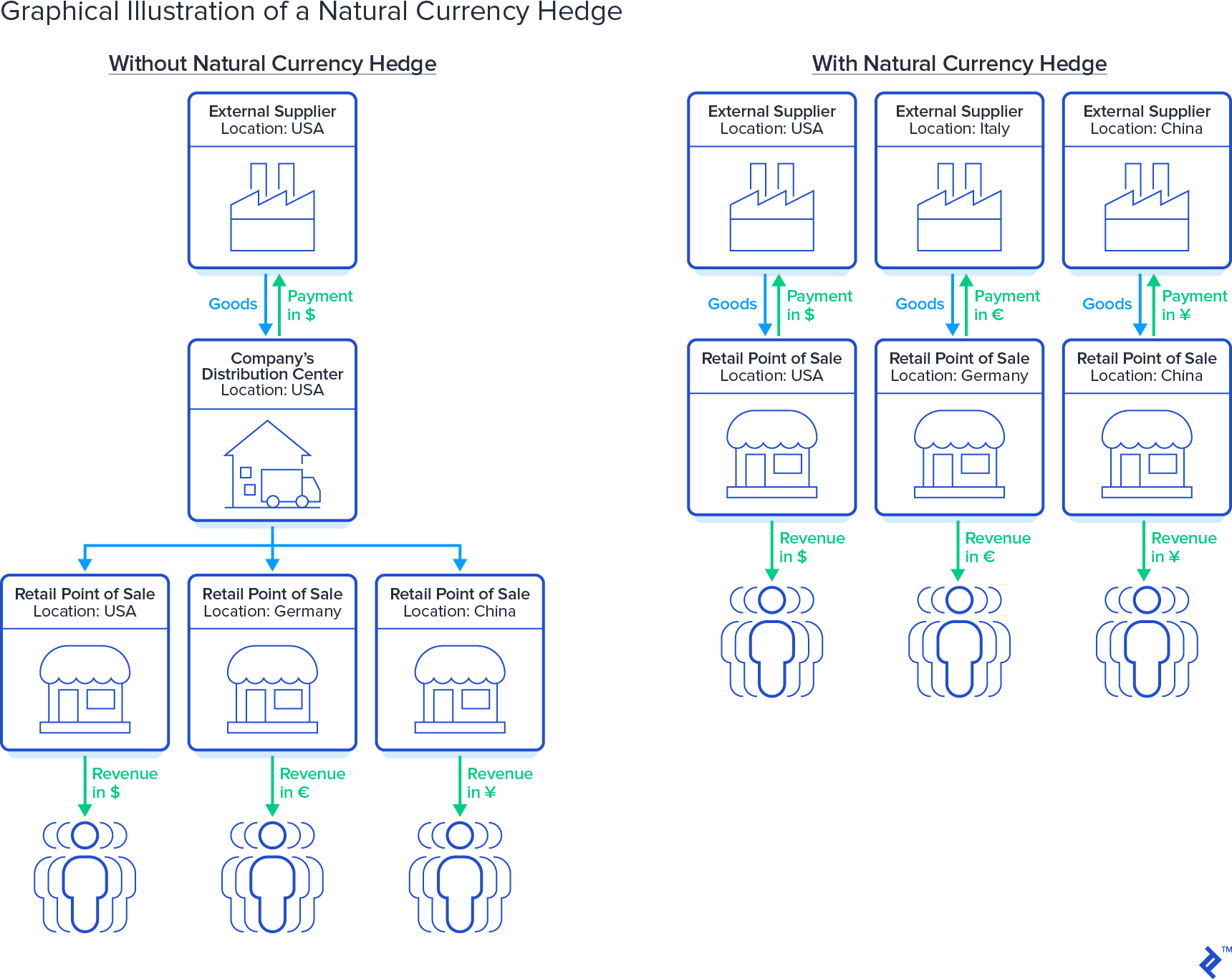

Exchange rate risk cannot be avoided altogether when investing overseas, but it can be mitigated considerably through the use of hedging techniques.

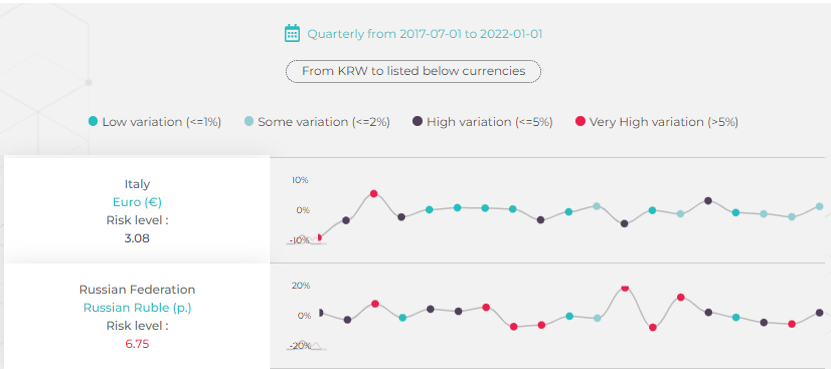

How to avoid exchange rate risk. It could be an easy way to. One of the simplest ways to avoid the risks associated with fluctuations in exchange rates is to quote prices and require payment in u.s. Transaction risk is the risk faced by a company when making financial transactions between jurisdictions.

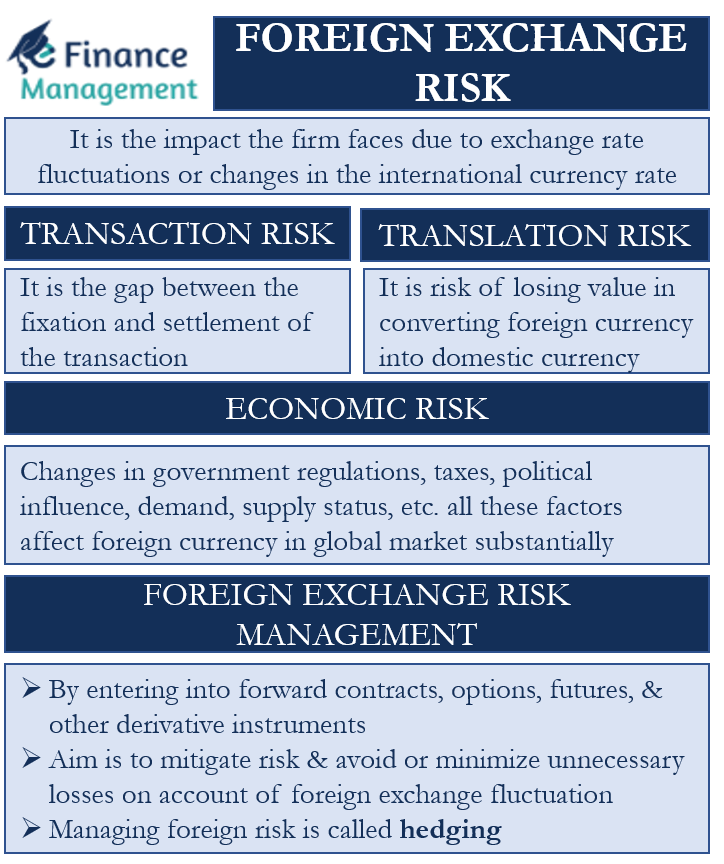

There are three major types of exchange rate risk: Financial derivatives have a reputation for complexity—and sometimes that reputation can be justified. How to avoid foreign exchange risk.

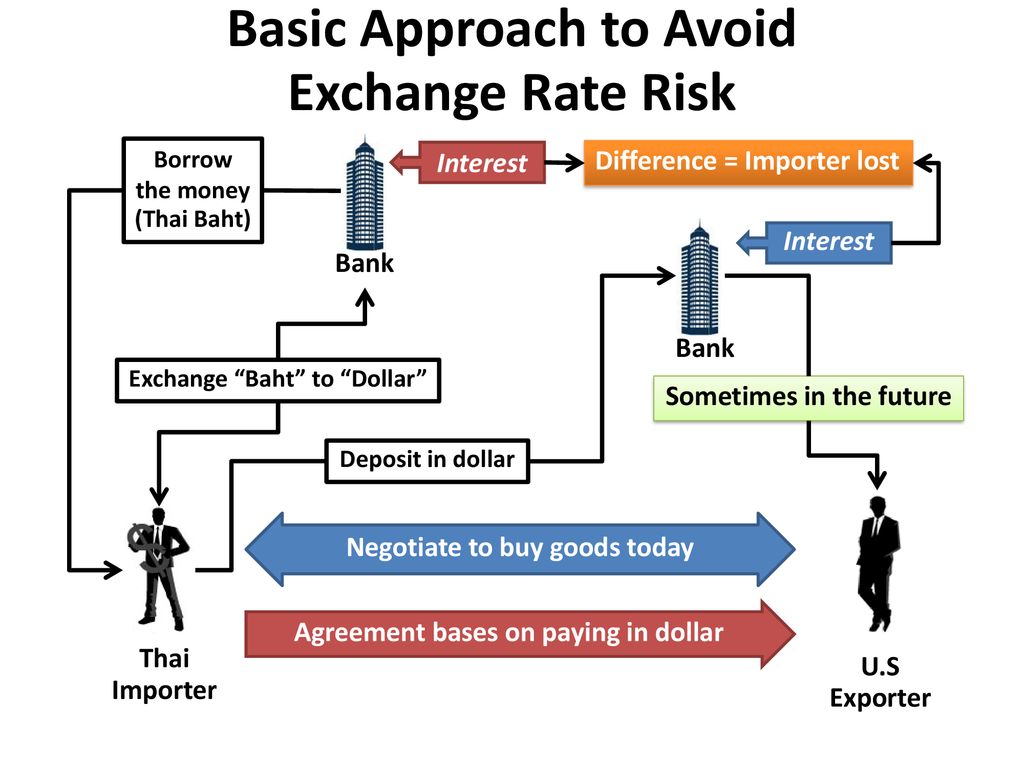

Then both the burden of exchanging. In other words, the exchange rate between. (exchange rates, forward exchange contracts, currency futures & currency options) one of the added uncertainties of conducting trade on an.

Exchange rate risk refers to the risk that a company’s operations and profitability may be affected by changes in the exchange rates between currencies. With a forward contract, you enter into a legal agreement to carry out an overseas money transfer at some point in the future by fixing an exchange rate in advance. Unfortunately, there is no getting away from it:

A forward contract gives the owner the obligation to buy or sell an. If you want to keep doing business internationally in the same way as you always have done, but with reduced exchange rate risk, you can consider using derivatives to hedge your exposure. The greater the market exposure, the greater the market risk.

Exchange rate risk cannot be avoided altogether when investing overseas, but it can be mitigated considerably through the use of hedging techniques. In order to eliminate the currency exchange risk they can use a currency forward exchange contract. The three types of foreign exchange risk include:

Due to mark’s estimated appreciation trend, two measures could be taken in relation to currency risk: You can now also invest in currency hedged funds, which build in the hedge to the holdings of the fund. An etf comprises a collection of securities bundled together and.

No hedging, converting dm 3 million into. Invest in currency hedged funds. For example, a business involved in raw material trading usually hedges close to 100 per cent of their.

Every company that imports or exports from or to countries outside the eurozone inevitably has to deal with foreign. Transaction risk is when rates change before your transaction is finished.

/GettyImages-1197760630-5c570c2c43db4fe79d11563aa8cdd196.jpg)

/GettyImages-157380238-de8368377d114242af29d2d670382aa6.jpg)